As the new year approaches, it’s the perfect time to reflect on your financial goals and set a budget to achieve them. Budgeting is a crucial tool for managing your finances, reducing debt, and achieving your financial aspirations. In this article, we will explore how to get your budget ready for the new year and pave the way for a more financially secure future.

Reflect on Your Financial Goals

The first step in preparing your budget for the new year is to reflect on your financial goals. What are you hoping to achieve in the coming year? Your goals could range from paying off debt, saving for a vacation, building an emergency fund, or investing for your retirement. Clearly defining your goals will help you tailor your budget to your specific needs.

Assess Your Current Financial Situation

Before creating a budget, you need to understand your current financial situation. Take a close look at your income, expenses, savings, and debts. Create a detailed overview of your financial picture. This will help you identify areas where you can cut costs and allocate more funds to your financial goals.

Create a Realistic Budget

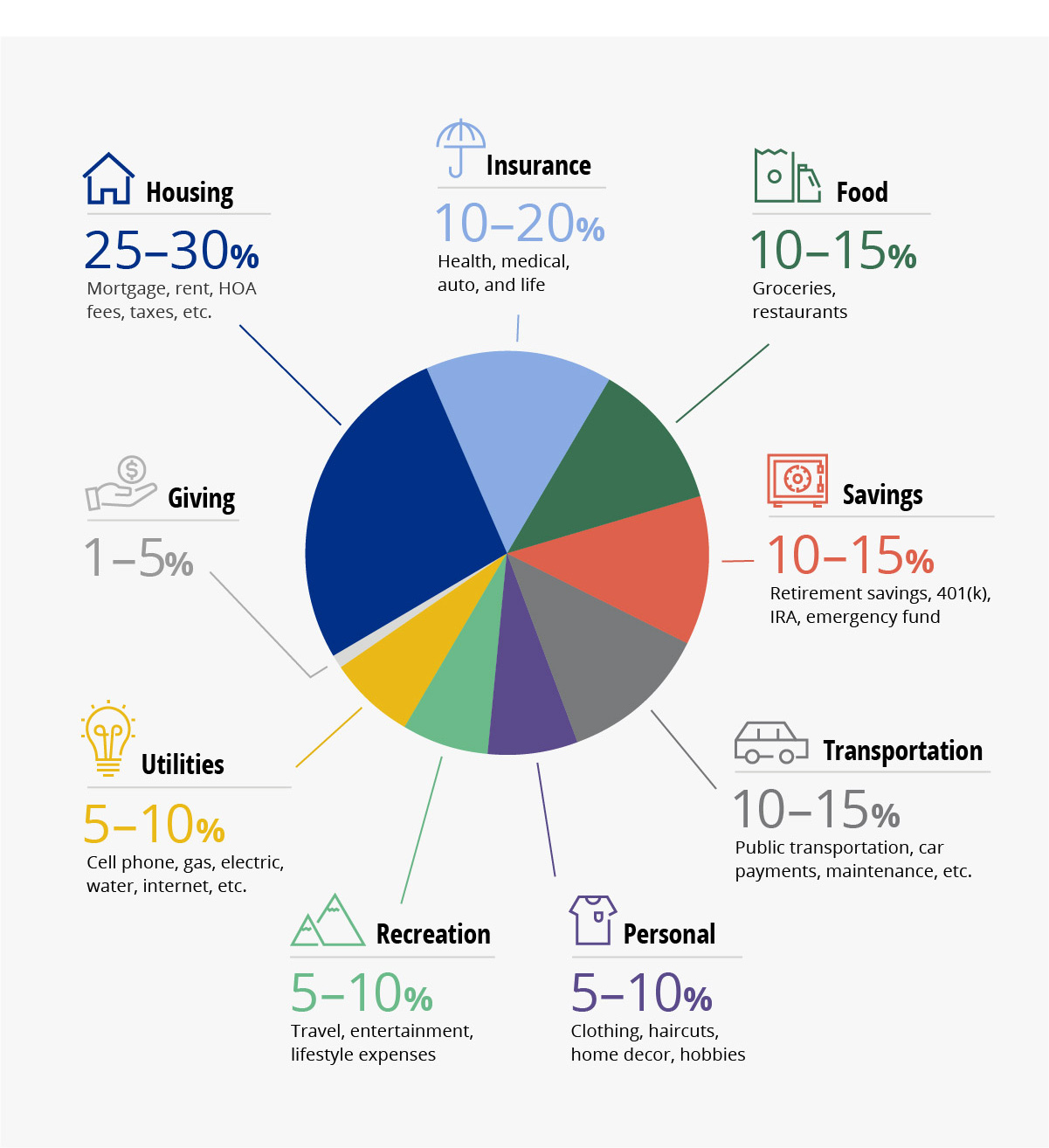

Once you have a clear understanding of your financial situation and goals, it’s time to create a realistic budget for the new year. Here are the key steps:

- List Your Income: Document all sources of income, including your salary, freelance work, investments, and any other income streams.

- Track Your Expenses: List all your monthly expenses, such as rent or mortgage, utilities, groceries, transportation, entertainment, and any other regular expenditures. Be thorough and include even the small, irregular expenses.

- Set Saving Goals: Allocate a portion of your income to your financial goals, such as savings, investments, and debt repayment.

- Prioritize Your Expenses: Rank your expenses in order of importance. Necessary expenses like rent, utilities, and groceries should come first, followed by savings and discretionary spending.

- Create Categories: Categorize your expenses into fixed (e.g., rent) and variable (e.g., dining out) to better manage your budget.

- Set Spending Limits: Determine how much you’ll spend in each category, and be realistic about your limits. Your budget should be sustainable over the long term.

Track Your Spending

After creating your budget, it’s important to track your spending regularly. Use budgeting tools, apps, or spreadsheets to monitor your income and expenses. This will help you stay on track and make necessary adjustments throughout the year.

Cut Unnecessary Expenses

As you track your spending, you may identify areas where you can cut unnecessary expenses. Be mindful of impulse purchases, recurring subscriptions you no longer need, or lifestyle choices that are draining your finances. Eliminating or reducing these expenses can free up money to put towards your financial goals.

Build an Emergency Fund

An emergency fund is a vital component of any budget. It acts as a safety net for unexpected expenses, such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses in your emergency fund to provide financial security.

Automate Savings and Debt Repayment

To ensure you meet your savings and debt repayment goals, consider automating these processes. Set up automatic transfers to your savings account and schedule debt payments to be deducted from your checking account. This will help you stay consistent and disciplined in your financial approach.

Review and Adjust Your Budget

Your financial situation and goals may change throughout the year, so it’s essential to review and adjust your budget as needed. Be flexible and make changes to your budget if your income or expenses change significantly.

Budgeting for the new year is a crucial step toward achieving your financial goals and securing your future. By reflecting on your goals, assessing your financial situation, and creating a realistic budget, you can set yourself up for financial success in the coming year. Remember to track your spending, cut unnecessary expenses, build an emergency fund, and automate savings and debt repayment. With dedication and discipline, you can make the most of your financial resources and work towards a more financially secure future in the new year.