Financial planning is an essential aspect of securing your financial future and achieving your long-term goals. Central to this process is determining your savings needs. Calculating how much you need to save is a fundamental step towards building a strong financial foundation. In this article, we’ll explore the key considerations and methods to calculate your savings needs.

Why Calculate Your Savings Needs?

Calculating your savings needs is vital for several reasons:

- Achieving Financial Goals: Whether it’s buying a home, sending your children to college, or retiring comfortably, savings are the key to realizing your financial aspirations.

- Emergency Fund: An emergency fund provides a safety net for unexpected expenses like medical bills, car repairs, or job loss.

- Debt Management: Savings can help you pay off debt, reducing financial stress and interest payments.

- Retirement: To retire comfortably, you need to save enough to maintain your desired lifestyle.

- Peace of Mind: Knowing you have enough savings provides peace of mind and financial security.

How To Calculate Your Savings Needs?

- Set Your Financial Goals: Start by clearly defining your financial goals. This could include short-term goals like a vacation or long-term goals like retirement.

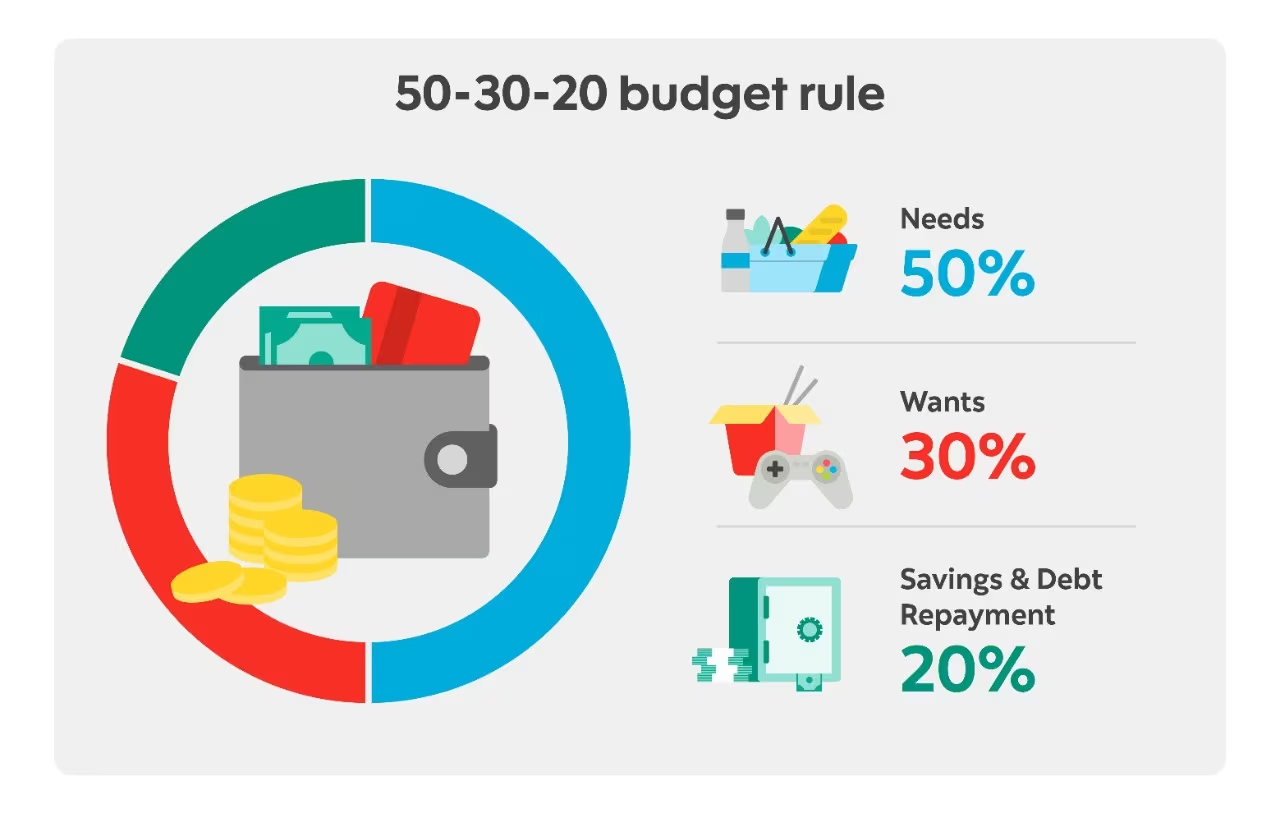

- Budget Your Expenses: Calculate your monthly and annual expenses. Categorize them as necessary (e.g., rent, utilities) and discretionary (e.g., dining out, entertainment).

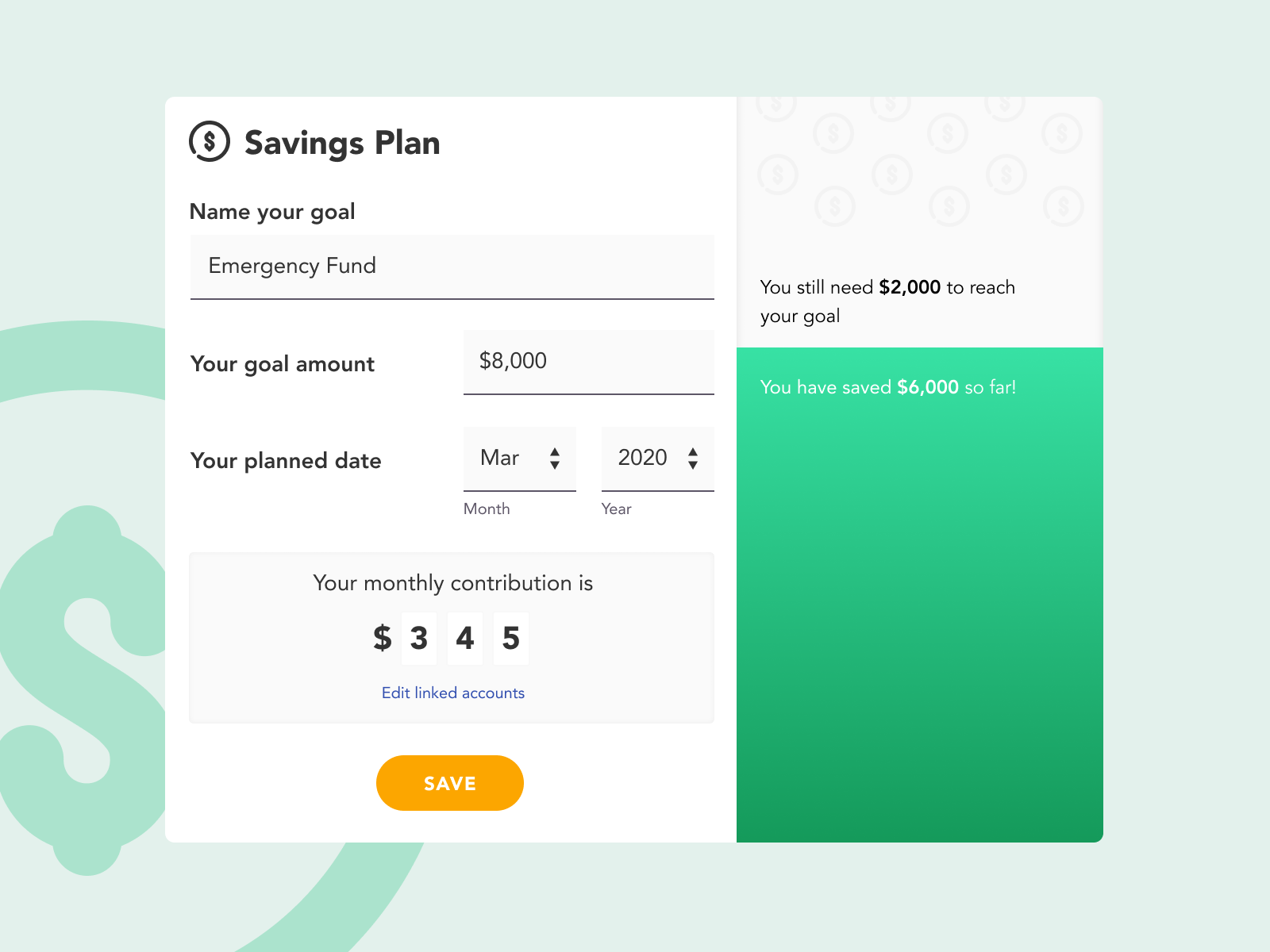

- Emergency Fund: Financial experts recommend having at least three to six months’ worth of living expenses in an emergency fund. Calculate your monthly expenses and multiply them by the recommended number of months to determine your emergency fund target.

- Debt Repayment: If you have outstanding debts, prioritize paying them down. Calculate how much you need to allocate to debt repayment each month, ensuring you make more than just minimum payments.

- Retirement Savings: For retirement, a common guideline is saving 15% of your annual income. Use retirement calculators to estimate how much you’ll need based on your age, current savings, and desired retirement age.

- Other Goals: Consider other savings needs like buying a home, paying for your children’s education, or starting a business. Calculate the amount you’ll need for each of these goals.

- Inflation and Investment Returns: Account for inflation and investment returns when calculating long-term goals. The purchasing power of your money will decrease due to inflation, so adjust your savings accordingly.

- Risk Tolerance: Understand your risk tolerance when planning for investments. Higher-risk investments may yield higher returns but also come with greater uncertainty.

- Consult a Financial Advisor: Consider consulting a financial advisor for a more accurate and personalized assessment of your savings needs.

Tools and Resources to Help You

- Savings Calculators: Many online tools and calculators are available to help you estimate how much you need to save for various financial goals. These calculators consider factors like inflation, expected returns, and the time horizon.

- Financial Planning Software: Dedicated financial planning software can provide a comprehensive view of your financial situation, helping you set and track savings goals.

- Professional Advice: Financial advisors can provide personalized guidance based on your unique circumstances and goals.

Calculating your savings needs is a critical step in your financial journey. It ensures you have a roadmap to achieve your financial goals, manage unexpected expenses, and build a secure future. Take the time to assess your financial objectives, create a realistic budget, and use the available tools and resources to estimate your savings needs accurately. With proper planning and discipline, you can set yourself on a path to financial success and peace of mind.